To promote understanding of the Group's businesses and issues among outside directors and outside Audit & Supervisory Board members, we have implemented various initiatives such as providing themed training videos, offering opportunities to participate in seminars conducted by the Group companies for internal and external stakeholders, and conducting training on the marketing services provided by the Group. Going forward, we will continue to explore and implement measures that enrich discussions of the Board of Directors and enhance its supervisory function.

Corporate Governance

Conducting Training for Outside Officers

Remuneration Committee and Nomination Committee

The Company has established the Remuneration Committee and the Nomination Committee as advisory bodies to the Board of Directors and ensures the transparency and reasonableness of the process for determining the appointment, dismissal, and compensation of the Company's directors and corporate officers through the deliberation and resolution of such matters by the Board of Directors. The status of attendance at meetings of these committees is indicated below.

Note: The status of attendance at Remuneration Committee meetings by directors Ikuko Arimatsu and Masanori Nishioka reflects meetings held after they were appointed in July 2022. In addition to the above number of meetings, the Nomination Committee held one meeting for written deliberation, which was deemed committee deliberation.

Activities of the Remuneration Committee

Activities by the Remuneration Committee as part of the process of deciding director remuneration for fiscal 2022 included the following.

Activities of the Nomination Committee

Activities by the Nomination Committee as part of the process of nominating directors in fiscal 2022 included the following.

Note: In addition to the above number of meetings, the Nomination Committee held one meeting for written deliberation, which was deemed committee deliberation.

The Board of Directors receives reports from the outside director who chairs the Remuneration Committee and Nomination Committee regarding discussions that took place at meetings of each committee during the respective fiscal year.

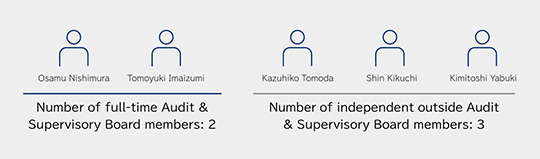

Audit & Supervisory Board

The Audit & Supervisory Board, which consists of five members, three of whom are outside Audit & Supervisory Board members, meets once a month, in principle, and whenever necessary. The Audit & Supervisory Board members audit the performance of director duties from the perspective of a holding company of the Group by attending the Board of Directors' and other important meetings, exchanging opinions with directors and key personnel, and receiving reports on the status of performance of the Group's advertising and integrated media companies.

Activities of the Audit & Supervisory Board (Fiscal 2022)

The Audit & Supervisory Board meets at least once a month, in principle, and additional meetings are arranged as necessary. In fiscal 2022, the Audit & Supervisory Board met 23 times, and the number of items raised with the Board was 81. The attendance of individual Audit & Supervisory Board members at meetings is detailed below.

| Position | Name | Attendance |

|---|---|---|

| Full-time Audit & Supervisory Board member |

Osamu Nishimura |

23/23 (100%) |

| Full-time Audit & Supervisory Board member |

Tomoyuki Imaizumi |

16/16 (100%) |

| Position | Name | Attendance |

|---|---|---|

| Outside Audit & Supervisory Board member |

Kazuhiko Tomoda |

23/23 (100%) |

| Outside Audit & Supervisory Board member |

Shin Kikuchi | 16/16 (100%) |

| Outside Audit & Supervisory Board member |

Kimitoshi Yabuki |

Appointed in June 2023 |

Note: The status of attendance at Audit & Supervisory Board meetings by full-time Audit & Supervisory Board member Tomoyuki Imaizumi and outside Audit & Supervisory Board member Shin Kikuchi reflects meetings held after they were appointed in June 2022.

Specific Agenda Items

Specific Audit & Supervisory Board agenda items are described below.

Meetings of Outside Directors and Outside Audit & Supervisory Board Members

Regular meetings of independent outside directors and outside Audit & Supervisory Board members are held to allow these officers to exchange information and build shared understanding based on their independent and objective standpoints. Full-time Audit & Supervisory Board members also attend these meetings as observers. The meeting for fiscal 2022 was held on June 9, 2022.

Director Compensation

Compensation System Basic Policy

- · Rooted in the Group corporate philosophy

- · Shared sense of value with our shareholders, incentivizing increases in corporate value over the medium to long term

- · Compensation levels appropriate for the roles and responsibilities of the directors of the Company and that secure and maintain superior human resources

- · Transparency and reasonableness ensured in the compensation decision process

Compensation Items

Director compensation is composed of three items: annual compensation, annual bonuses, and stock-based compensation. In reflection of their roles and their need to maintain independence, however, compensation for outside directors consists solely of annual compensation.

The percentage of the annual bonus and stock-based compensation, for which the amounts and values change according to business performance, is set at 40% of the total compensation for each director in the case of standard business performance.

-

①Annual Compensation

Annual compensation is decided based on the expected results, actual results, and other factors for the position and duties of each director.

-

②Annual Bonus (Short-Term Incentive)

The annual bonus provides a strong incentive to achieve business results in a given fiscal year and is decided comprehensively in consideration of the Group's profit level in each fiscal year, the achievement of management benchmarks, and the results of the individual directors in the individual year.

-

③Stock-Based Compensation (Medium- to Long-Term Incentive)

Stock-based compensation is a form of compensation in which restricted stock is provided each year to directors to incentivize the increase of corporate value over the medium to long term and provide a shared sense of value with shareholders.

Annual Bonus Calculation Method

Annual bonuses are calculated by multiplying a standard value set for each director (one-twelfth of annual compensation) by a bonus coefficient and then adjusting this amount by the performance of a given director in the respective fiscal year.

Consolidated operating income before amortization of goodwill is the primary indicator used for determining annual bonuses. Other indicators considered include ordinary income and income before income taxes as displayed on the consolidated statements of income.

Bonus coefficients are adjusted within the range of 0% to 200%, with 100% representing the accomplishment of targets.

In assessing the performance of individual directors, the degree of accomplishment of individual targets set at the beginning of the fiscal year is evaluated qualitatively.

Stock-Based Compensation (Restricted Stock) Allocation Method

Directors are allocated monetary remuneration receivables in an amount set on an individual basis and they then conclude restricted stock allocation contracts with the Company. Directors use these receivables to make in-kind contributions to the Company, after which they receive allocations of restricted stock.

The restricted stock allocation contracts impose a 30-year period for transfer restrictions on the allocated shares. These transfer restrictions, however, can be canceled if a director's term expires or they resign from their position for another reason deemed appropriate during the transfer restriction period.

Should a director resign from their position for reasons not deemed appropriate by the Board of Directors during the transfer restriction period, the Company shall claim the allocated shares of restricted stock with no compensation provided.

Policies for Determining Compensation

The Remuneration Committee has been established as an advisory body to the Board of Directors. The majority of the members of this committee are independent outside directors, and an independent outside director serves as the chairperson.

Levels of annual compensation, annual bonuses, and stock-based compensation paid to directors are decided by the president based on authority delegated by the Board of Directors. Authority for deciding director compensation, etc., has been delegated to the president by the Board of Directors. This authority, however, is conditional upon the Remuneration Committee's review of the president's proposal to ensure transparency and reasonableness.

Policies for Determining Compensation of Audit & Supervisory Board Members

The compensation of Audit & Supervisory Board members is composed solely of annual compensation pursuant to the Internal Rules on Audit & Supervisory Board Member Compensation and is determined through consultation among the Audit & Supervisory Board members.

General Meeting of Shareholders' Resolutions Regarding Director Compensation

The following resolutions have been made by the General Meeting of Shareholders regarding the compensation of directors and Audit & Supervisory Board members.

Total Amount of Compensation by Class of Directors, Total Amount of Compensation by Type of Compensation, and Number of Directors Receiving Directors Compensation

Corporate Governance Guidelines

These guidelines set out the views of Hakuhodo DY Holdings Inc., the holding company of the Hakuhodo DY Group, regarding our corporate governance as well as an overview thereof. The contents of these guidelines have been determined by a resolution of the Company's Board of Directors and will be examined and updated by the Board once a year.