A.At the Hakuhodo DY Group, we view investments as strategic expenses for strengthening our business foundation, including the expansion of human resources well-versed in digital and other technologies. We also view investments such as mergers and acquisitions (M&A) as actions that directly impact the balance sheets.

Strategic expenses are geared toward realizing organic growth over the medium to long term. In a sense, they function as the seeds, fertile soil, and water needed for growing our business.

With the rapid progression of digitalization, it is crucial that we secure personnel who can implement digital marketing activities. It is also imperative that we increase the number of personnel well-versed in technologies to establish a foundation for future growth. Being able to respond to technologies such as artificial intelligence (AI) and extended reality (XR) is key. Furthermore, as we work to transform our business structure, we must reform our workstyles and establish a sustainable operating structure. The expenses we are currently investing serve as the cornerstone for steadily implementing such initiatives.

However, these kinds of investments take a certain amount of time to produce results. As we are currently in the phase of foundation building, our expenditure on investments is greater than usual. We therefore expect that our profit growth will be much more gradual than it has been in the past.

We will need to continue investment even after the conclusion of the current Medium-Term Business Plan. Once we have achieved a certain level of progress with establishing our business foundation, however, our basic approach will be to keep selling, general and administrative expenses within the range of gross profit growth and strive to steadily improve our operating margin.

In addition, to accelerate the speed of growth, we must incorporate external functions and capabilities through such methods as M&A and capital alliances.

With regard to global business domains, in particular, gross profit from our overseas businesses accounts for over 20% of our total consolidated gross profit. Accordingly, we need to execute M&A in order to further enhance these businesses.

Moreover, domestically, we are considering M&A as an option for further enhancing our product lineups in digital, marketing execution, and other domains. We also recognize capital alliances as an effective means for bolstering our technological capabilities.

I would like our investors to understand that we do not view M&A simply as a tool for expanding the scale of our business. Rather, the purpose of executing M&A is to augment our strengths in the areas in which we are lacking, enhance our product lineups, and enhance operating efficiency through the generation of synergies.

Interview with the CFO

- Masanori Nishioka

- Representative Director

& Senior Executive Corporate Officer

CFO

We will execute investments for future growth

while building a financial foundation that supports such investments,

thereby enhancing the Group’s corporate value.

Q.Please tell us your basic approach to investment.

Q.You stated that, as a general rule, you aim to keep expenses within the range of gross profit growth. Could you please tell us your thoughts on investment discipline, including for capital expenditures and M&A?

A.Obviously, we aim for a return and profit that is commensurate with the amount we invest. As a basic policy, we aim for a return that exceeds the cost of capital.

We recognize that the Group’s current cost of capital stands at around 7%, and we determine hurdle rates for investment at major operating companies keeping this figure in mind.

Also, in terms of investment limits, we believe that we should be able to cover investment and shareholder return amounts through cash flows generated by our operating activities.

Timing is also an important element of investment, so we will not necessarily reject an investment if the amount exceeds cash flows generated by operating activities in the near term provided the investment meets certain criteria. In such instances, we will make use of funds procured from external sources and then aim to balance out the repayment of the investment amount over the medium to long term.

In other words, we will always strive to maintain a balance of net cash over the medium to long term.

Q.Under the Medium-Term Business Plan, you are actively promoting investment in order to reinforce your business foundation. Aside from expenses that directly impact profits, to what degree are you planning to execute investment?

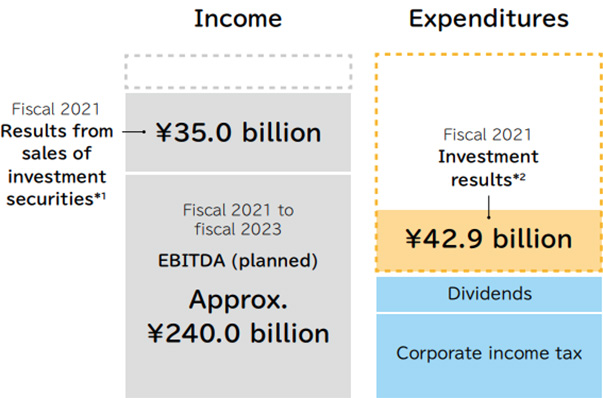

A.To explain our investment plans over the period of the Medium-Term Business Plan, which runs through fiscal 2023, if we consider our results for investments in fiscal 2021 and the outline for investments in fiscal 2022, and in the event that we achieve our targets for fiscal 2023 (the final year of the Medium-Term Business Plan), total earnings before interest, taxes, depreciation, and amortization (EBITDA) will come to approximately ¥240.0 billion. Furthermore, if we assume over the same period that the total payment of corporate income tax and dividend payments trend at the same level as in fiscal 2021, we should have around ¥100.0 billion remaining at the end of the plan. This amount serves as the basis of our estimations of the investment limit that I mentioned earlier. If we factor into this limit the sales of investment securities conducted in fiscal 2021, the future sale of Group-owned assets, and the balance of net cash at the time we revised our Medium-Term Management Plan, I believe that we will be able to make investments at amounts that exceed the limit while still maintaining a sound financial position.

Meanwhile, in fiscal 2021, we invested approximately ¥10.0 billion in acquiring tangible and intangible assets. As we are aggressively investing in technologies and rethinking our office layouts, we will most likely invest greater amounts in acquiring such assets in the remaining two years of the plan.

Also, we acquired SoldOut,Inc. via a takeover bid (TOB) in fiscal 2021, and we will continue to actively enhance our functions through M&A and capital alliances going forward. However, as other parties are involved, I am unable to clarify exactly how much we will invest in such initiatives at this time.

In conclusion, however, I am able to say that we plan to invest over ¥100.0 billion in building our business foundation over the three-year period of the plan and that we have enough financial capacity to do so.

Outline of EBITDA

from Fiscal 2021 to Fiscal 2023

- Notes: 1. EBITDA is calculated by adding depreciation expenses to operating income before amortization of goodwill.

- 2. Figures for fiscal 2022 and fiscal 2023 are rough estimates based on certain assumptions. Accordingly, the accuracy of these figures cannot be guaranteed.

Outline of Expenditures

from Fiscal 2021 to Fiscal 2023

- Note: Figures for EBITDA, dividends, and corporate income tax are rough estimates based on certain assumptions. Accordingly, the accuracy of these figures cannot be guaranteed.

- *1 Income from sales of investment securities on the consolidated statements of cash flows for fiscal 2021

- *2 Total of payments to acquire investment securities, payments for investments in capital, payments from purchase of investments in subsidiaries and capital resulting in change in scope of consolidation, and proceeds from purchase of shares of subsidiaries resulting in change in scope of consolidation, payments from purchase of investments in subsidiaries and capital, payments from purchase of investments in subsidiaries not resulting in change in scope of consolidation (cash flows from investing activities), and other items on the consolidated statements of cash flows for fiscal 2021

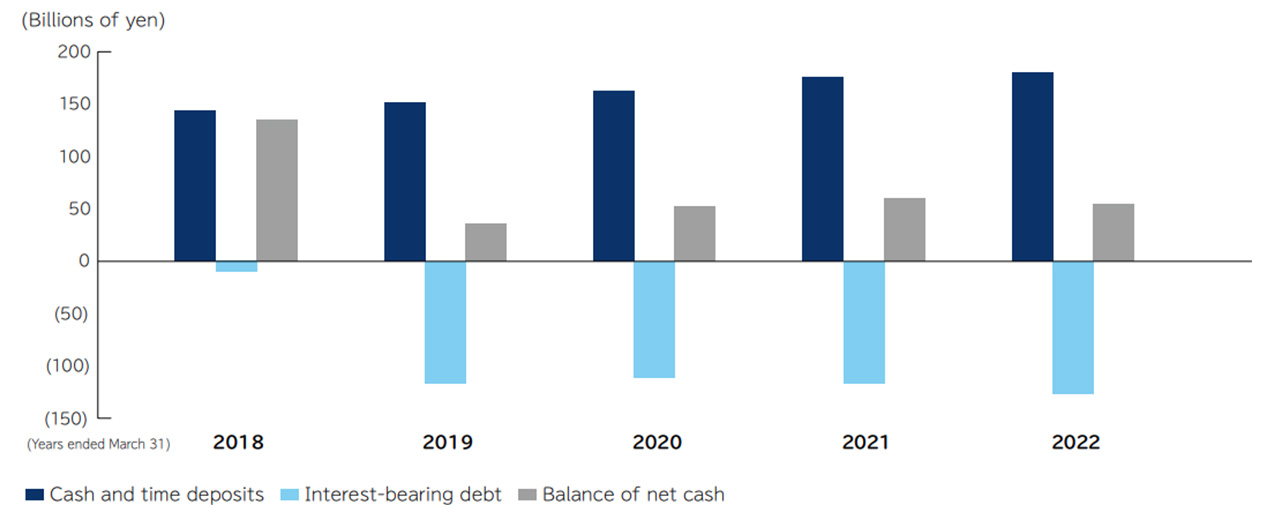

Q.You mentioned that you will maintain a balance of net cash even after investing over ¥100.0 billion throughout the three-year period of the plan. How do you view the Group’s current financial position?

A.Looking at our business cycle, we would like to maintain a balance of cash and cash equivalents totaling around one month’s worth of billings. On average, we record billings of at least ¥100.0 billion a month, so we intend to raise funds with an awareness of that level.

At the fiscal 2021 year-end, cash and time deposits stood at ¥183.9 billion, and interest-bearing debt was ¥126.4 billion, resulting in net cash of ¥57.5 billion.

Interest-bearing debt of ¥100.0 billion remains from when we turned D.A.Consortium Inc. (DAC) into a wholly owned subsidiary in 2018. In terms of fundraising, we will make relevant decisions while considering our cash level as well as our investment plans. The financial market is undergoing significant changes, and we understand that we must diversify our fundraising activities as a result.

At the end of fiscal 2020, which was directly before we revised our Medium-Term Business Plan, our balance of net cash amounted to ¥62.8 billion. As I mentioned previously, we expect expenditures to balance out during the period of the Medium-Term Business Plan, even with our strategic expenses and investment in M&A and other areas. To that end, we believe we can maintain financial soundness even if there are slight deviations to our investment plans or the timing of income and expenditures.

In September 2022, we received an A+ credit rating from Rating and Investment Information, Inc. (R&I), demonstrating that rating institutions also believe that the Group is in a stable financial position.

Cash and Time Deposits, Interest-Bearing Debt, and Balance of Net Cash as of the Past Five Fiscal Year-Ends

Q.Capital markets have suggested that the Group has too many cross-shareholdings.

A.That is correct; the issue has been brought to our attention.

At the end of fiscal 2021, investment securities came to ¥136.6 billion. Not all of this amount constitutes cross-shareholdings, as it includes shares held in affiliates. However, the total of “special investment shares” disclosed in our fiscal 2021 annual report was ¥80.2 billion. I believe that the reason some investors have this perception is because this amount represents 22% of our equity.

Every year, we review the purpose and economic impact of our cross-shareholdings and gradually sell off those shares that we have no logical reason to retain. We understand that we are in an era in which there are strong demands for companies to reduce their cross-shareholdings, and we therefore intend to sell off our cross-shareholdings in a manner that does not inconvenience the investee companies, thereby enhancing our capital efficiency.

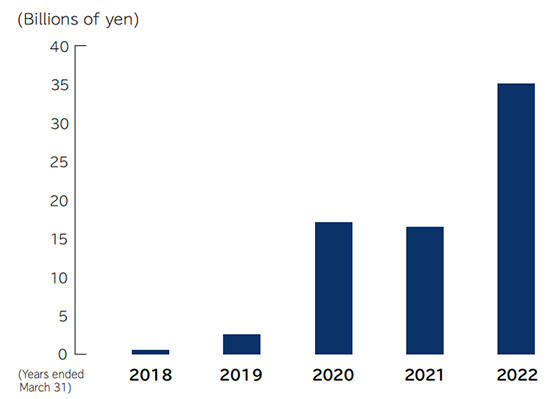

Actually, over the past five years, we have sold off a total of ¥71.7 billion in investment securities, with ¥68.6 billion of this amount constituting sales of investment securities conducted over the past three years. I ask that our investors understand our approach to addressing this matter.

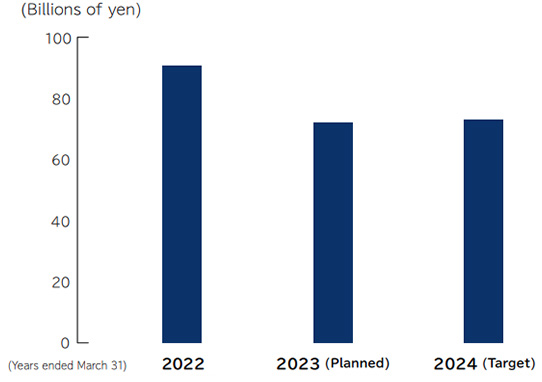

Results of Sales of Investment Securities over the Past Five Fiscal Years

Note: Income from sales of investment securities on the consolidated statements of cash flows

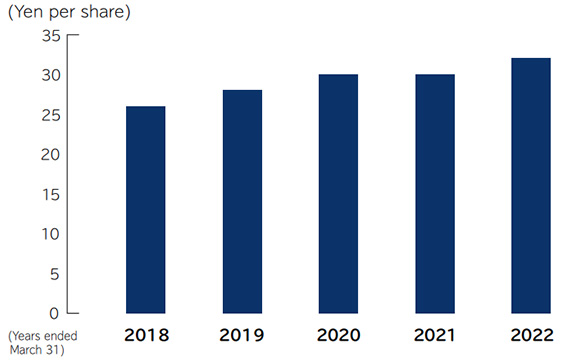

Q.Please tell us your approach to shareholder returns.

A.Our basic policy is to provide stable dividend payments based on our desire to offer long-term economic benefits to our shareholders. Even with the temporary decline in profits amid the COVID-19 pandemic, we have continued to maintain and increase our dividend levels. Although we forecast a decline in net income in fiscal 2022, we intend to leave our dividend levels unchanged. We are also constantly examining buyback of our shares as a means to provide additional returns and enhance capital efficiency.

I talked about how we aim to maintain a balance of net cash as an indicator of financial soundness, but I also feel that, in cases where we believe we have more than a sufficient amount of funds, we need to keep open the option of providing additional shareholder returns, even while taking various risks into consideration. We will examine whether or not we have sufficient funds to do so by, for example, observing the ratio of net cash to equity capital.

That said, we will also seek to flexibly acquire our shares in accordance with changes in the operating environment. We will decide on whether to buy back shares not by looking at the level of cash and time deposits we are maintaining but rather based on a comprehensive consideration of factors such as our financial position, business performance, demand for funding, and trends in our share price.

Results of Annual Dividends

over the Past Five Fiscal Years

Q.In closing, from your position as CFO, is there anything you would like to convey to the readers?

A.Investments for future growth are indispensable. To that end, I believe my role as CFO is to help the Group build a financial foundation that underpins the cycle from investment to growth and ensure that this effort leads to the enhancement of corporate value. I ask for the continued support and encouragement of all of stakeholders as we strive toward this goal.