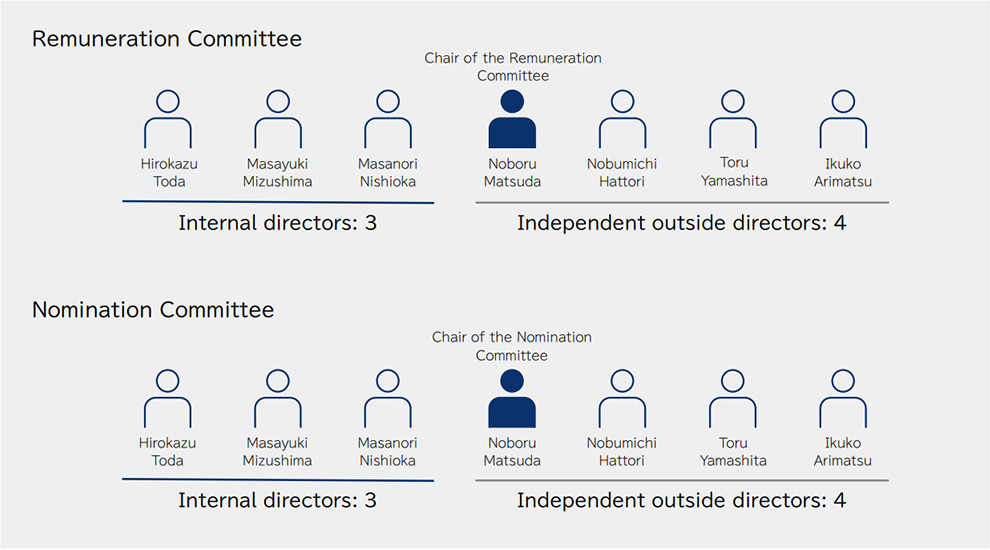

The Company has established the Remuneration Committee and the Nomination Committee as advisory bodies to the Board of Directors and ensures the transparency and reasonableness of the process for determining the appointment, dismissal, and compensation of the Company’s directors and corporate officers through the deliberation and resolution of such matters at the Board of Directors’ meetings.

Note: Compositions of the Remuneration Committee and the Nomination Committee are as of October 31, 2022.

Activities of the Remuneration Committee

Activities by the Remuneration Committee as part of the process of deciding director remuneration for fiscal 2021 included the following.

| Number of meetings | 4 | |

|---|---|---|

| Major discussion topics | · Annual director compensation and total remuneration levels | · Total annual bonuses for fiscal 2021 |

| · Annual compensation amounts for individual directors in fiscal 2021 | · Annual bonus amounts for individual directors for fiscal 2021 | |

Activities of the Nomination Committee

Activities by the Nomination Committee as part of the process of nominating directors in fiscal 2021 included the following.

| Number of meetings | 3 | |

|---|---|---|

| Major discussion topics | · Appointment, dismissal, and areas of responsibility for director and Audit & Supervisory member candidates and corporate officers for fiscal 2022 | |

| · Formulation of a skills matrix | ||

The Board of Directors receives reports from the outside director who chairs the Remuneration and Nomination committees regarding the discussions that took place at meetings of the Remuneration Committee and the Nomination Committee during the respective fiscal year.